You’ll see lots of websites claiming, “public liability insurance costs $X per month” or “the average is $500/year for small business insurance.” These claims often ignore the complexities behind underwriting. I hope the details above highlight some of the challenges in coming to an exact figure without going through the formal quoting process. Many fail to account for:

- The specific trade or industry (some have higher risk).

- The level of cover (some use $5 million, but contracts usually ask for more than this)

- The work area or states involved (riskier locations get higher premiums).

- Past claims or loss history.

- Safety systems or lack thereof.

- Subcontractor use.

If they just pick one “typical” scenario and generalise it, it comes across as misleading. Small business operators already have enough going on to be wasting time. There is no worse feeling than thinking you are going to pay one amount, and it turns out to be a totally different, and a more expensive amount. Two small businesses in the same trade can pay dramatically different premiums because of those factors above. So, when comparing quotes for public liability insurance across Australia, always ask your broker what assumptions they made, and what you’d pay if your profile changes.

This is why at Bluewell we usually avoid giving ballpark figures or quotes without discussing your situation. We want the cover to be right for you, and a mechanic can’t fix your car without looking under the hood. Why is insurance any different?

A few alternative guides put averages in other terms:

One source says small business owners may pay ~$63.53 per month (~$760/year) for basic cover. (HMD Insurance 2022) But they also say $50, and $30, and $100… well which one is it? And how did they get these figures?

I will also note that the entity type, your business legal structure, whether you are a sole trader or company or partnership, has no effect on the actual premium for small business insurance products. Although it can be a great risk management tool in its own right, best to speak to an accountant or legal professional about potential legal structures and their consequences.

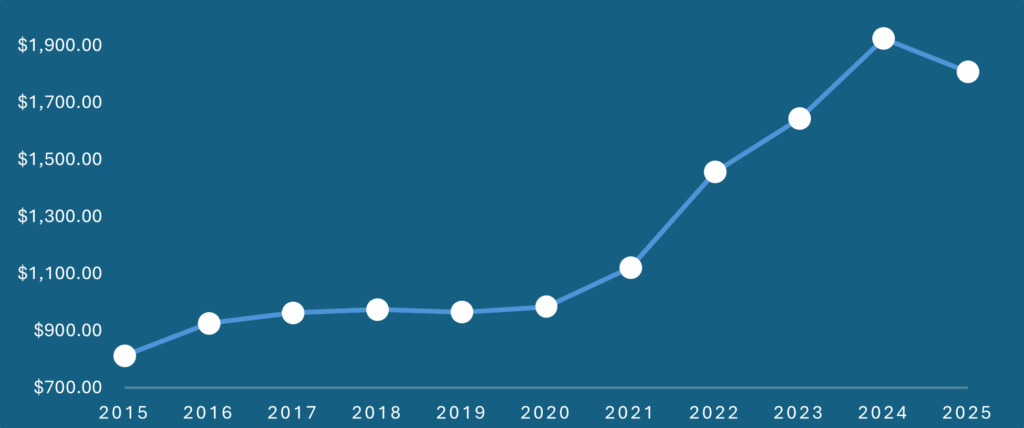

Another quote says small business owners can expect ~$68.50/month (~$820/year) for public liability. (Public Liability Australia, 2025) It implies regardless of if you are a butcher, a baker, or a dressmaker this is the estimate. These are three completely independent occupations that have their own underwriting criteria. At least this website references where they got their figures from, but it’s noted from 2018…. Our internal data above shows a 70% increase in premium post 2020 compared to 2015-2020.

Sprintlaws guide on liability insurance costs for small businesses often pops up when searching for the cost of public liability insurance for small businesses in Australia, including when using a LLM to search for reputable sources. However, again the most glaring issue with their information is the lack of transparency in where they source their figures from. Are they internal figures? Taken from industry reports or government insights? Or are they simply just pulling a figure out of thin air?