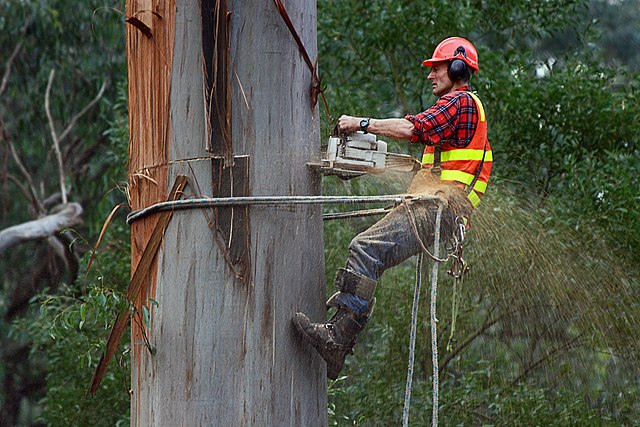

Tree lopping and arborist work is one of the most hazardous trades in Australia. Every day, businesses and sole operators in this industry are exposed to risks involving chainsaws, heavy branches, falling trees, powerlines, and working at heights.

While skill, training, and equipment reduce danger, accidents can still happen. A branch can fall unpredictably. Machinery can fail. Property can be damaged. And in serious cases, people can be injured. When these events occur, your business can be held legally responsible, and the financial impact of a single claim could be devastating.

Insurance for tree loppers and arborists is designed to provide financial protection for these risks. It covers legal liability, property damage, injury to third parties, and in many cases, the theft or damage of equipment. Without adequate cover, your livelihood, assets, and even personal finances could be at risk.