Railway Insurance

Railway Insurance

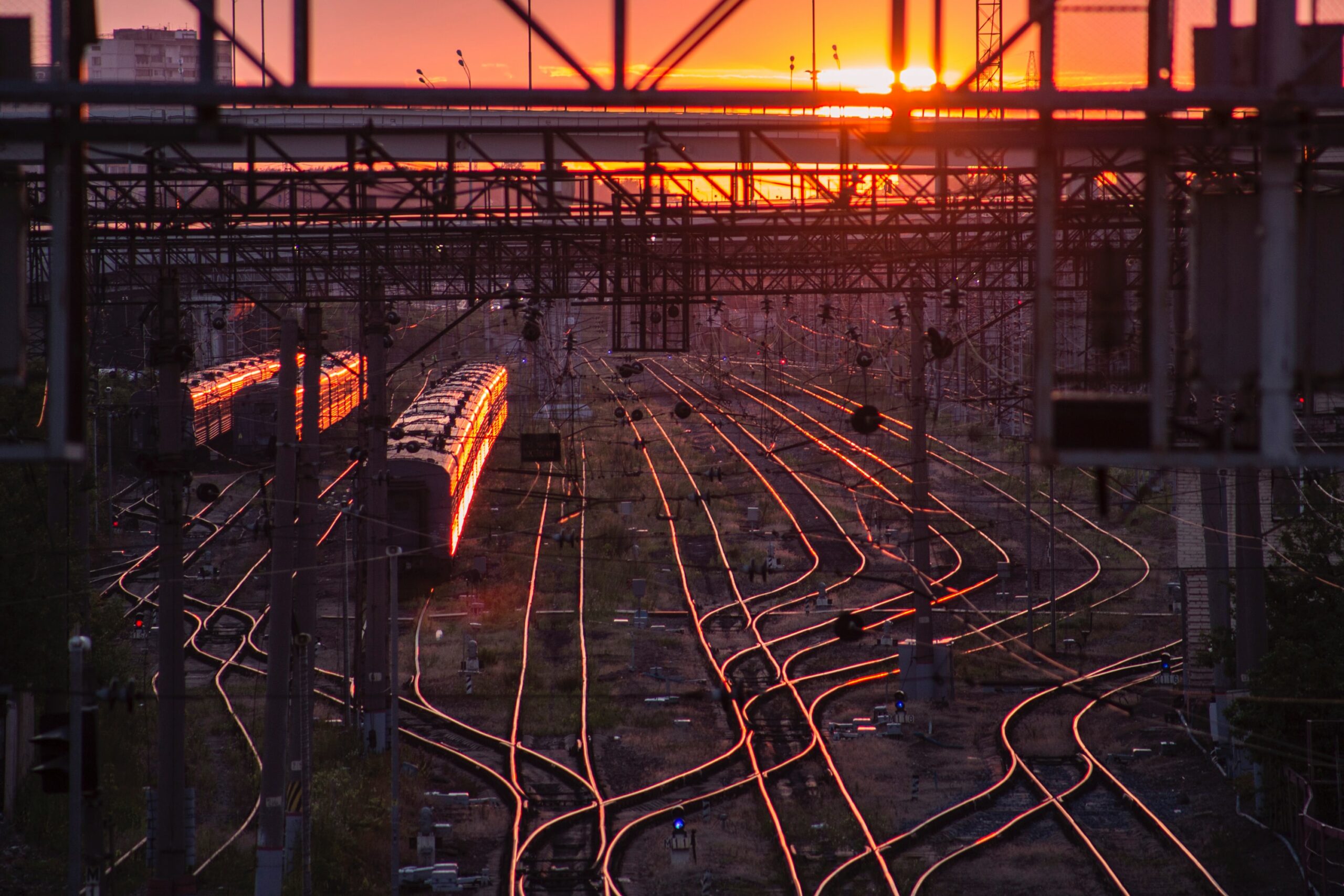

Railways are nowadays everywhere. Do you want to go to the next city? Take the train. Do you want to go deeper into the neighbourhood? Take the train. Do you want to go another country and don’t like flying? Take the train.

Since railways are crucial for literally keeping us on track, we want to know that they are as safe as possible. Not only for the passengers but also for the owners of the railway company – which is why a railway insurance is a must-have.

Who Needs Railway Insurance?

Basically, every contractor who works on a railway who does any type of work, be it signalling, track work or even mechanics and machine workers need to be covered and everyone having ownership of railways should have this type of insurance. Thus, in the case of a liability claim where you are found legally liabile for damage, the insurance company would be the one to pay for the costs. Having long railways means that you will have to offer if continuous maintenance – but there are times when things do not go as they plan. This is exactly why a railway insurance plan should be put in order. Since railways are fully exposed to both people and Mother Nature, you never know what may come as a liability to your business.

Risks and Issues That Railway Insurance Can Help With

Without the railway, the train will no longer have what to connect to, making it go off the rails. You will put your product at risk, but also the lives of the people. But you can rest assured that Bluewell will help you get the right cover to help you in the case of an incident causing damage or injury as well as get you cover for your buildings and property. Now, wouldn’t it have been better if you had an insurance company to back you up?

In the railway industry, most insurance companies can help you with risks and issues such as:

Regulatory requirements:

- Positive train control

- Statutory caps on liability

- Statutory minimum coverage

- Tank car specifications

- Transporting hazardous material

- System safety and work staff training

Liability exposure:

- Natural catastrophes

- Theft

- Accidents

- Extra expenses due to business interruptions

Property loss:

- Occupational injuries

- Environmental and site contamination

- Product liability

- Public injuries

- Contingent liability

- Damage of a third-party property

- Enterprise risk management

- Natural disaster preparedness and recovery

- Crisis readiness

- Terrorism

- Fleet safety

- Cyber intrusion

- Captive management

- Safe passenger/freight integration

Collaborating with the right insurance company may just make your railway go from local to full-on global. It is advised that you offer utmost attention to your insurance strategy so that you will not have to suffer from any future damage or lawsuits. Bluewell Insurance Brokers can help you out in case you are looking for insurance. They can calculate what the best plan is for you depending on your company, and give you advice on the options you should consider for having a damage-free business. Don’t take any chances. Secure the financial situation of your company and opt for the right insurance right now!

Call today on 1300 669 664 or get a quote here.